How to reduce loan amounts

There are a lot of really good reasons to reduce the amount of loans you take out each term. First, there is a limit to the amount of loans you can take out, and running out of money before graduating is a serious risk. Next, you don’t want to spend the rest of your life in repayment, do you? After you graduate, you’ll want to keep as much of your paycheck as possible, and reducing your loans now can result in significant savings later on.

So only take out the smallest amount you need to get by! Here’s how to borrow less.

Option 1: Change your award

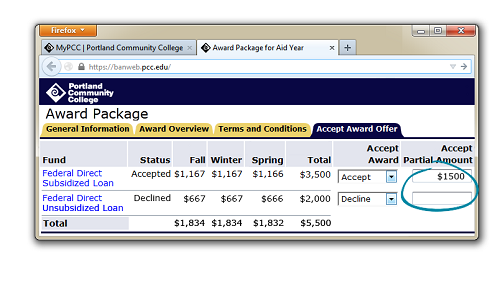

- When you accept your award, you are not required to accept the full amount of your loans! You can choose how much student loan debt you are taking on.

- Decide how much you need to borrow, and enter the amount in the “Accept Partial Amount” box. For help deciding how much to borrow, see planning what to borrow.

- If you decide later that you want these loans, you can request to have them reinstated.

Option 2: Revise your loan

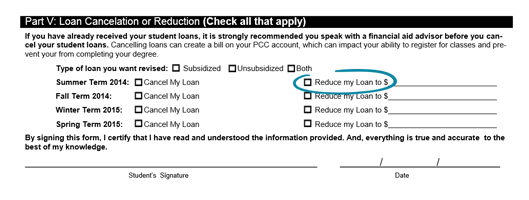

- If you have already accepted your award, you can still reduce the amount by submitting a loan revision request form (find the form at the bottom of the review your award page). Loan revision forms only work for loans that have not yet been disbursed.

- After you have filled out your Student Information in Part I, look at the bottom of the form for Part V: Loan Cancelation or Reduction. Choose the type of loan to revise, and the amount you would like your loan reduced to.

- Submit the form to the Financial Aid Office.

Option 3: Return a portion of the loan to PCC

- You can return a portion of the loan you’ve already received to any Student Account Services office within 14 days of disbursement. We will return the money to the Department of Education and reduce the amount you owe.