How to Hire an F-1 International Student

Step 1: Student needs Social Security Number

If the student does have a Social Security Number already, move to step 2.

If the student does not have a Social Security Number:

- Once offered a position, a student will need to successfully apply for and receive a Social Security number before they begin work on campus.

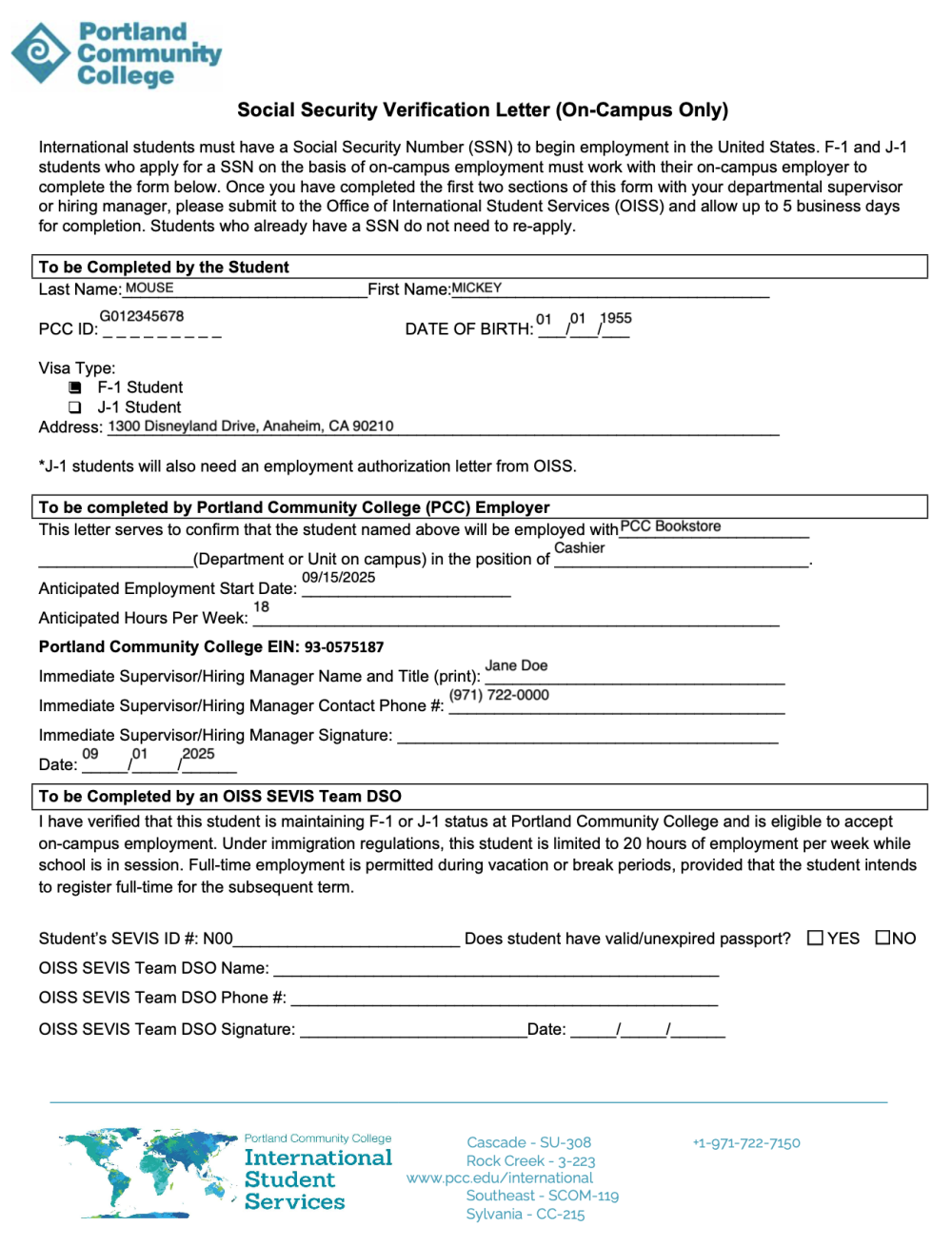

- The hiring manager will help the student get this process started, by filling out a portion of the student’s Social Security Verification letter. Please see who completes which sections of the form in the table below.

- The student must have a Social Security Number in order to begin working or training.

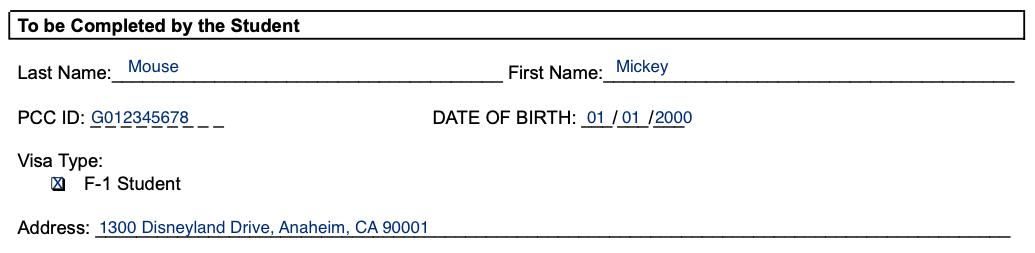

Student

The student takes responsibility for making sure each section of the Social Security Verification form is filled out.

- The student begins by completing the first section of the form.

- The student must take this form to the hiring manager to complete the next section.

- After the hiring manager has completed their section, the student must take this form to the OISS to complete the last section.

- Once the form is complete, the student must bring the Social Security Verification form, along with the other listed required identification documents, to a Social Security Administration office and apply for a SSN.

Visit Applying for SSN for more information

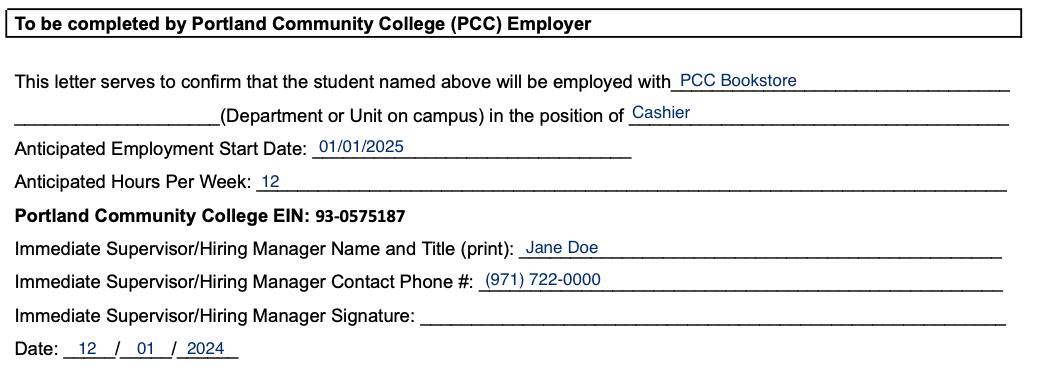

Hiring Manager/Department

The hiring manager must complete the second section of the Social Security Verification form in order for a student to apply for a Social Security Number.

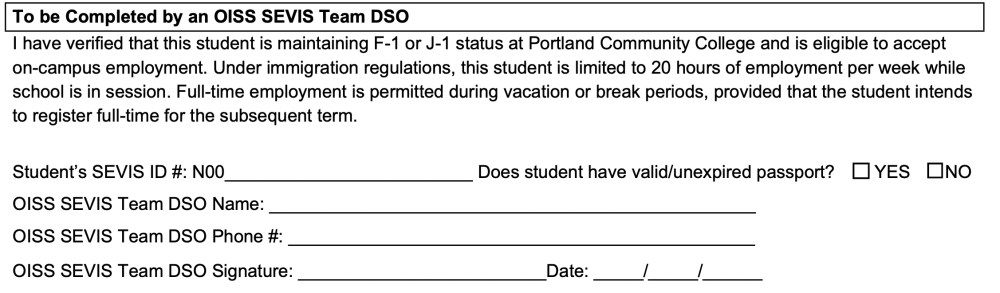

OISS

Once the first two sections of the Social Security Verification form have been completed, the SEVIS Coordinator in the OISS will fill out the last section. This last signature must be in wet ink (not electronic).

Step 2: Employer hires student in Workday

NOTE: The student must have a Social Security Number in order to be hired in Workday and begin working or training.

For assistance, please contact PCC’s PSEC (HRIS-group@pcc.edu) or Payroll department (payroll-group@pcc.edu).

Information for Payroll / Taxes

F-1 international students do have taxes withheld from income earned in the United States, with some exceptions. F-1 students who have been in the U.S. less than five calendar years, are nonresident aliens for tax purposes. Most PCC international students will be classified as such.

A nonresident student is exempt from FICA/FUTA (social security, medicare, unemployment) withholding, if enrolled in 6 or more credit courses each term they work.

- PCC’s Payroll department will need to receive a copy of the international student’s I-20 and/or visa, along with the W-4, in order to process these exemptions.

- Students can refer to Internal Revenue Service publications 515 and 519 for further information.

Approximately 45 countries have tax treaties with the United States. Students from a tax treaty country may have part of their income exempt from federal taxation. Students who claim this exemption must be able to prove eligibility under the tax treaty. Summaries of these treaties can be found in IRS Publication 901. (If a student wishes to claim a tax treaty exemption, they must file IRS Form 8233 [pdf] upon completing the I-9, along with a requisite statement as outlined in Appendix A of IRS Publication 519.)

Frequently Asked Questions

Who are F-1 international students?

- International students who enter the United States using an F-1 student visa. (The OISS supports students on the F-1 visa.)

- Although the primary purpose of an F-1 student’s status is to study in the United States, this visa allows for on-campus employment.

- How to Verify if Student is International in Banner

- More information on an F-1 international student’s eligibility for employment and limitations on work is available on our Student Resources: Employment page.

Can F-1 international students work on campus?

- Yes, F-1 international students can work on campus without any special permission from immigration as long as:

- the work does not exceed 20 hours per week, unless on their vacation term

- the student has maintained their F-1 immigration status

- Since on-campus work does not require any special work authorization, students do not need an Employment Authorization Document (EAD), nor an authorization from the SEVIS Coordinator.

Are F-1 international students limited to the number of hours they can work?

- F-1 international students must not work more than 20 hours per week, unless on their vacation term

- F-1 international students must be maintaining their F-1 status in order to work on-campus

- Since on-campus work does not require any special work authorization, students do not need an Employment Authorization Document (EAD), nor an authorization from the OISS.

What is a vacation term?

- PCC offers courses during four terms per year: Fall, Winter, Spring, and Summer. An F-1 international student is required to study full-time (12 credits) for at least 3 terms in a year. One term per year can be taken as a vacation term, during which students are not required to be enrolled full-time. A vacation term is usually taken during the Summer term.

Can F-1 international students work off campus?

- The regulations allow for practical training for F-1 students, only when approved by the SEVIS Coordinator.

- More information on F-1 international students’ eligibility for off-campus employment and limitations on work is available on our Student Resources: Employment page.

- Practical training allows for paid or unpaid employment in the student’s field of study at an off-campus location. There are two types of practical training: Optional Practical Training (OPT) and Curricular Practical Training (CPT). Please see the links below for further information: